Hey, friends. Alex here.

A few years back, Mike was in the same boat as many of us—worried about rising grocery bills and unsure how to grow his $7,000 nest egg. He knew he needed a solid retirement investment strategy, but with a steady job and two kids, and no fancy finance degree, he felt completely stuck.

The world of investing seemed like a club he wasn’t invited to, full of jargon and scary charts. The fear of making a wrong move was so strong that it led to the worst move of all: doing nothing.

Then, he stumbled upon our website’s core belief: simple, diversified investing can work wonders. This isn’t about timing the market or chasing trends. It’s about having a plan. Here’s how Mike turned his anxiety into action and built a future he could finally feel good about.

Step 1: Keeping It Simple with Low-Cost ETFs

The first thing Mike did was let go of the pressure to be a stock-picking genius. Instead of chasing “hot stocks” that his friends were talking about, he embraced our idea of long-term, simple focus.

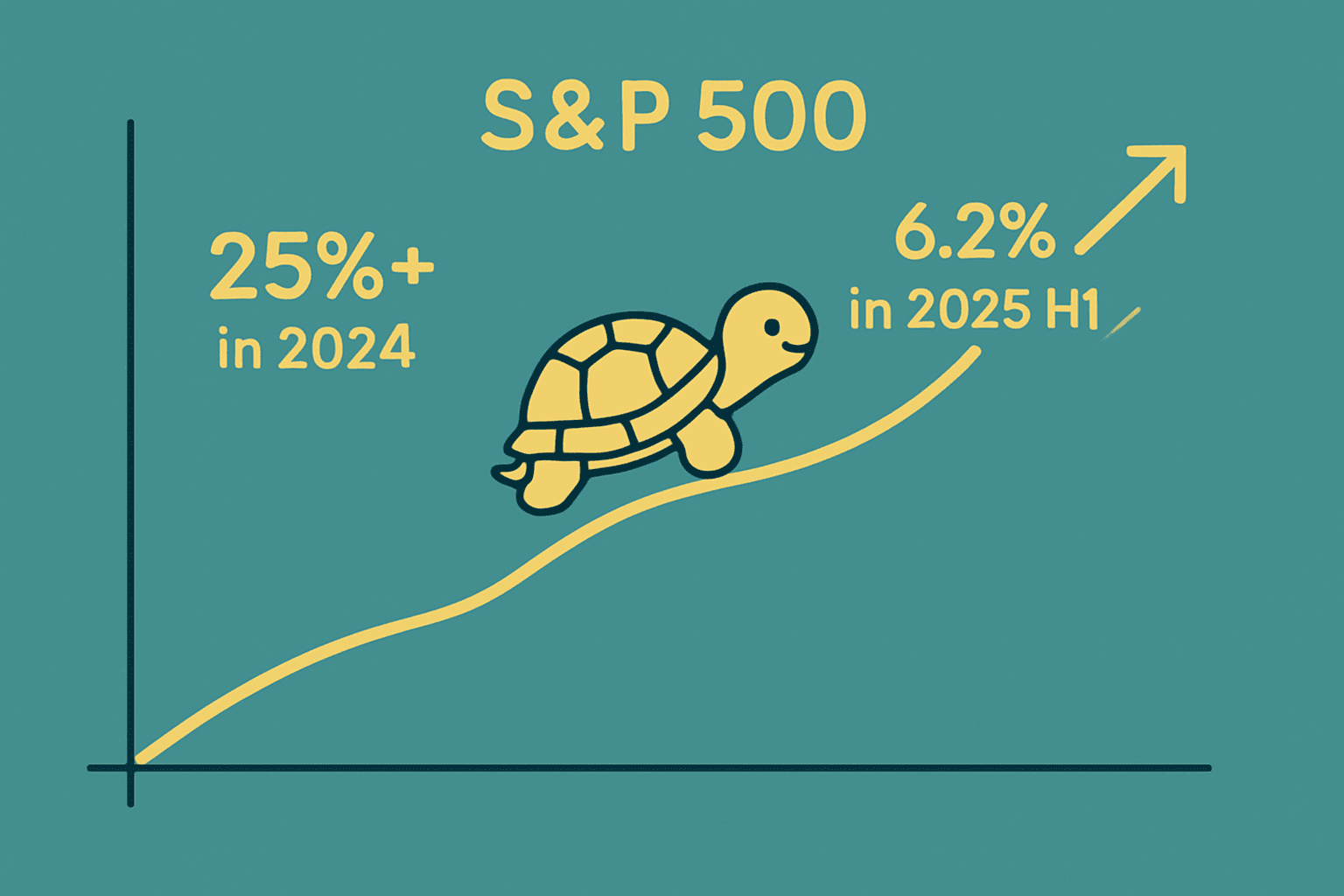

He picked a low-cost index fund ETF—Vanguard’s VOO, which tracks the S&P 500, with a tiny 0.03% fee. Why an ETF? As the financial experts at Investopedia explain, ETFs offer instant diversification and low costs, making them an ideal starting point for most investors.

He set up a $200/month automatic investment plan. No stress, no guesswork. It was a decision he made once, and it has been working for him in the background ever since.

After 5 years, his $12,000 in contributions has steadily grown to about $14,500. This assumes a conservative 7% average annual return. That number isn’t just pulled from thin air; it’s a reasonable benchmark based on the stock market’s long-term performance, a topic that financial education sites like Investopedia frequently cover in their analysis of the S&P 500.

“It’s like planting a tree,” Mike says. “I just give it a little water every month, and it grows while I’m busy with the kids. My simple retirement investment strategy started with just letting go of the need to be complicated.”

Step 2: Diversifying for a Good Night’s Sleep

Once his core investment was automated, Mike took another one of our ideas to heart: managing risk to reduce stress. A core part of his new retirement investment strategy wasn’t just about growth, but about building a portfolio that wouldn’t give him heartburn during market wobbles.

He added two more “safety net” ETFs to his mix:

1. A Dose of Healthcare: Mike put a small portion of his portfolio (about 5%, or $350) into a healthcare ETF like Vanguard’s VHT (0.10% fee). Why healthcare? It’s what’s known as a “defensive” sector. Even when the economy is shaky, people still need doctors and medicine. This resilience has given VHT a stable track record, making it a perfect tool to balance out the broader market’s ups and downs. In a year, that quiet winner grew from $350 to nearly $450.

2. A Piece of Real Estate: To hedge against inflation, he also added a small REIT (Real Estate Investment Trust) ETF like Vanguard’s VNQ (0.12% fee). This allowed him to tap into the real estate market without being a landlord. According to NAREIT, the worldwide representative voice for REITs, these investments can provide both dividend income and long-term appreciation. This gave him peace of mind, knowing his money was growing in different ways.

“The S&P 500 is my engine,” Mike grins. “VHT and VNQ are my seatbelts and airbags. It’s my safety net.”

Step 3: Learning the Rules and Staying the Course

The final, and perhaps most crucial, part of Mike’s journey was building the right mindset. This is where our practical education vibe really clicked for him.

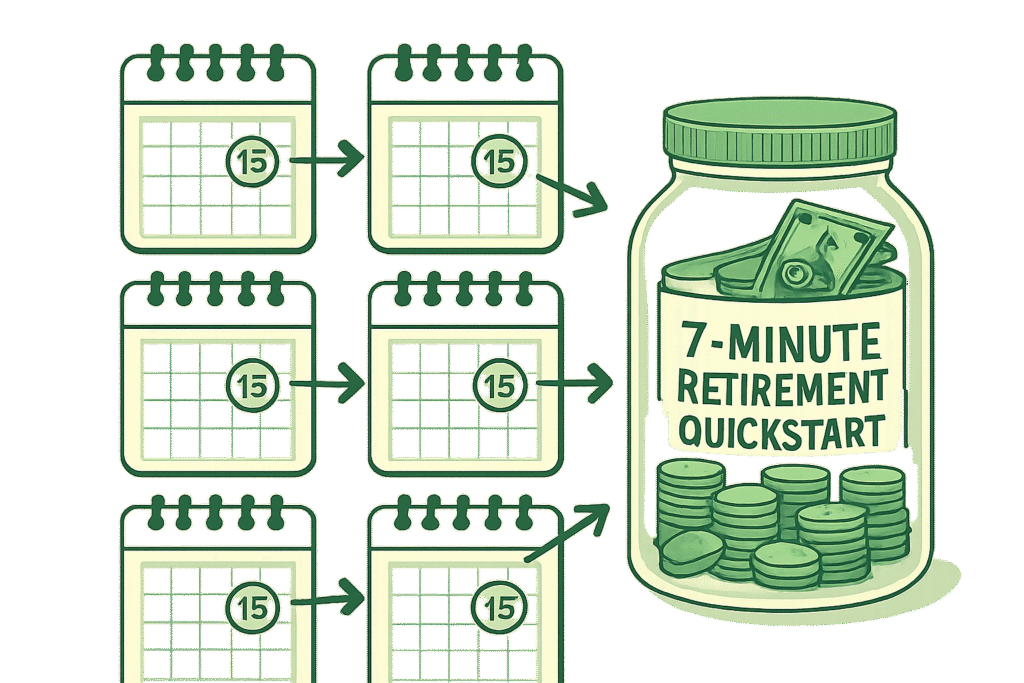

He grabbed our free [7-Minute Retirement Quickstart PDF] to learn the ropes. The guide didn’t just teach him what to buy; it taught him why he was buying it and, more importantly, why he should hold on.

So, when scary headlines about new tariffs or inflation spikes hit the news, he didn’t panic-sell like many others do. He understood that market noise is just that—noise. His retirement investment strategy was built for decades, not days. He remembered the lessons from the guide and stuck to his plan.

Knowing that he had a well-thought-out plan, based on proven principles, allowed him to shift from fear to focus. He wasn’t trying to predict the future; he was simply preparing for it.

The Big Win: More Than Just Numbers

Fast forward to today: Mike’s initial $7,000 has blossomed to over $9,000 in just a few years, thanks to his steady contributions and market growth.

But the real win isn’t just the number in his account. He didn’t need to be a Wall Street wizard—just a dad who trusted a simple, diversified plan.

His emergency fund is secure. His retirement savings are on track. But most importantly, he sleeps better at night. He’s no longer worried about every headline or market dip because he has a system. He’s in control.

Your Turn to Win: A Recap of Mike’s Plan

Mike’s story proves that a smart retirement investment strategy doesn’t need to be complicated. Low-cost ETFs, smart diversification, and a long-term view can turn small, consistent steps into big wins.

Your own retirement investment strategy can be this simple too:

- Start with a Core ETF: Pick a low-cost, broad-market ETF like VOO and set up an automatic monthly investment.

- Add for Balance: Consider adding 5-10% in a defensive sector ETF (like VHT) or a REIT ETF (like VNQ) for diversification.

- Set It and Forget It: Let time and compounding do the heavy work for you.

Ready to start? Grab my free [7-Minute Retirement Quickstart PDF] and join Mike on this journey. Check out more stories like this at our [Real Wins] section.