Hey, friends. Alex here.

Are you tired of all the complicated investing advice out there? Do you ever wish there was a simpler, saner way to build wealth? Then you might be ready to discover common sense investing.

This entire philosophy was famously championed by the late John C. Bogle, the founder of Vanguard. He literally wrote the book on it, a bestseller called The Little Book of Common Sense Investing. His message was simple yet revolutionary: You don’t need to be a genius to build a secure financial future.

So, what exactly is common sense investing, and how can you put it into practice today? Let’s break down Bogle’s 3 core rules.

Rule #1: Embrace the Power of Diversification

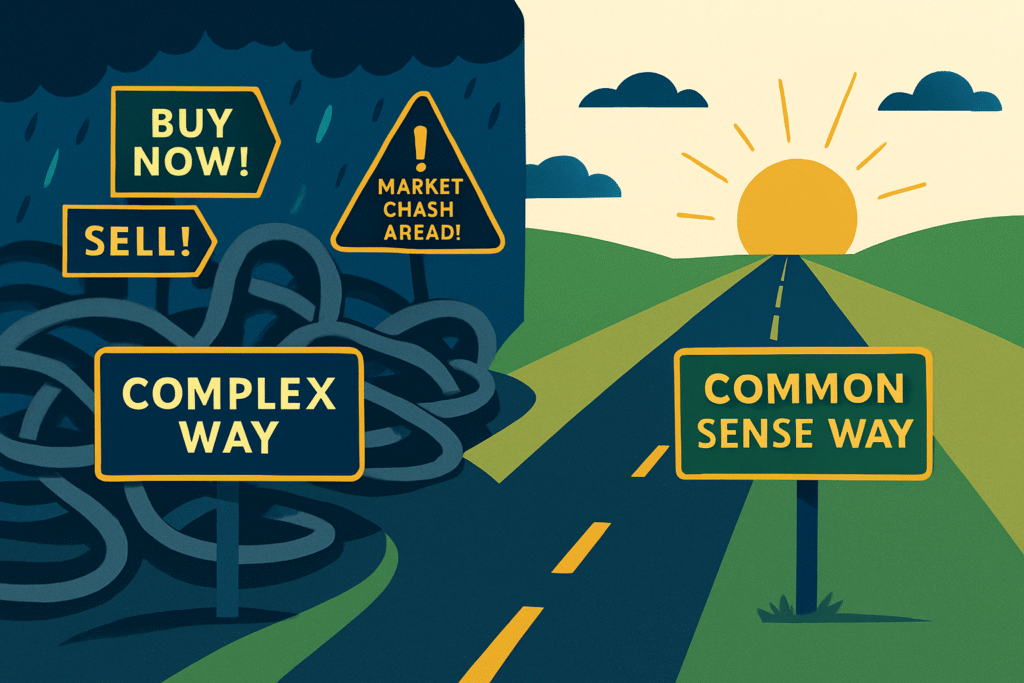

Bogle believed that most investors spend far too much time trying to pick the “next big thing.” They chase hot stocks, listen to guru predictions, and try to time the market.

He thought there was a far better way: Instead of trying to beat the market, simply own the entire market. His solution was the index fund, a single investment that holds small pieces of hundreds or even thousands of different companies.

Bogle’s simple solution was the index fund, a single investment that holds the entire market. I break down exactly how to choose your first low-cost ETF in my simple guide, 5 Simple Steps to Start Investing with Just $100.

Rule #2: Wage War on High Costs

Bogle’s second rule was to wage a war on costs. He understood a simple truth that many investors forget: fees matter, a lot.

The most common fee you’ll encounter in funds is the ‘expense ratio.’ As this in-depth guide from CNBC explains, even a seemingly small expense ratio can have a huge impact on your long-term returns. These fees are like termites, slowly eating away at your profits year after year.

That’s why Bogle was such a staunch advocate for low-cost investing. By choosing funds with minimal fees, you keep more of your money working for you.

Rule #3: Stay the Course for the Long Haul

Bogle wasn’t a fan of quick trades or market timing. He preached the power of long-term investing and the magic of compounding.

He knew that the market would have its ups and downs, but he believed that, over the long run, it would always trend upward.

His advice was simple: Choose a sound investment strategy, stick with it through thick and thin, and let time do the heavy lifting. This is why understanding the core principles of common sense investing is much more valuable than trying to time the market.

The beauty of Bogle’s philosophy is that it has empowered millions of regular people to build wealth. You can see a modern example of this in Mike’s story, where he used these exact principles to build his retirement savings.

Common Sense Investing: It’s Not Just About Money

While Bogle’s strategy is simple, it’s not always easy. The hardest part is often tuning out the noise and resisting the urge to chase quick profits.

It requires discipline, patience, and a commitment to a long-term vision. But the rewards are well worth the effort. By following Bogle’s rules, you can not only build wealth but also gain something even more valuable: peace of mind.

Make Common Sense Investing

The first step in applying common sense investing is often the simplest one: You need a plan and you need the right tools.

As Bogle taught us, the key is to keep it simple and keep your costs low. My guide on how to start investing with just $100 shows you how to put these big ideas into small, manageable actions. It’s completely free, and it’s designed to give you the confidence to take that first step.

So, are you ready to embrace the power of common sense investing? It’s not about getting rich quick; it’s about building a solid financial foundation that will support you and your family for years to come. And that’s a win worth celebrating.

Grab my free [7-Minute Retirement Quickstart PDF]. It’s the simple map you need to start building a future that’s secure, no matter what your starting point is.