Hey, friends. Alex here.

Does the idea of “saving money” make you feel a little tired? For years, I thought saving meant sacrifice, complicated budgets, and cutting out everything I enjoyed.

It felt like a chore, and honestly, I was terrible at it.

If you’re looking for some easy saving tips that don’t feel like punishment, you’ve come to the right place.

I’m going to share the three simple, almost “painless” shifts in mindset that changed everything for me. This isn’t about giving up your daily coffee; it’s about setting up a smarter system that works for you, not against you.

Let’s dive in.

Tip #1: Pay Yourself First (The Automation Trick)

This is the golden rule, the one tip that, if you only follow one, will make the biggest difference.

Most of us treat saving as an afterthought. We pay our bills, we spend on groceries and fun, and then we hope there’s something left over at the end of the month to save.

Usually, there isn’t much.

“Pay Yourself First” flips that script entirely. It treats your future self as the most important bill you have to pay.

Here’s how it works: On the day you get paid, before you pay anyone else, you automatically transfer a set amount of money into a separate savings account.

It could be $50, $100, whatever feels manageable. The key is that it’s automatic. You set it up once, and it happens every time.

This simple shift in mindset is a well-known financial principle. As the experts at Investopedia explain, ‘Pay Yourself First’ is a foundational rule for building wealth because it prioritizes saving over spending.

You’re no longer relying on willpower; you’re relying on a system.

Tip #2: Name Your Buckets (The Motivation Trick)

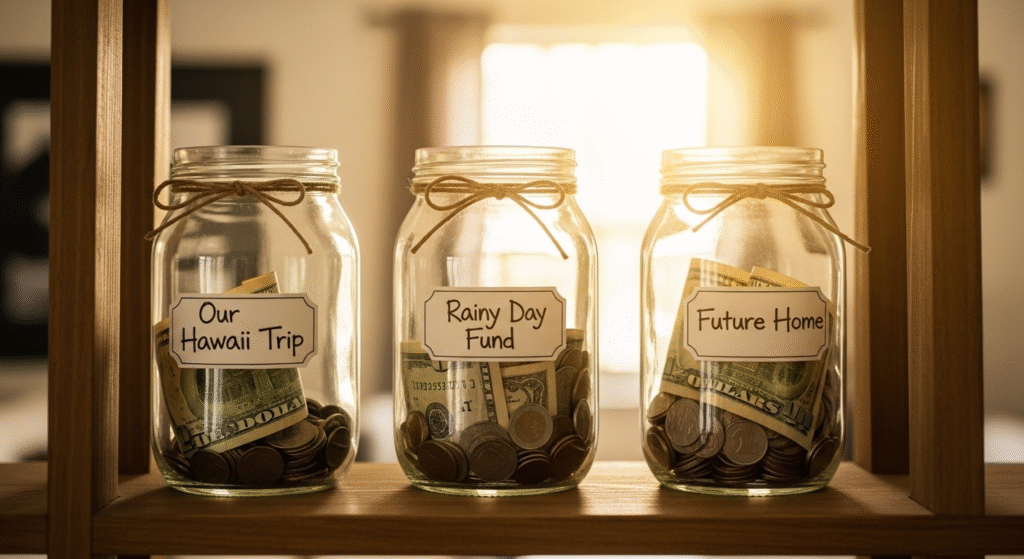

Saving money for the sake of “saving” is boring. It lacks purpose, and it’s hard to stay motivated. This is where our second tip comes in.

Give your money a job. Give it a name.

Instead of having one giant savings account, create separate “buckets” or “pots” for specific goals. Most high-yield savings accounts let you do this easily online.

Name them something that excites you:

- “Hawaii Family Vacation Fund”

- “New Laptop for My Side Hustle”

- “Debt-Free by December Fund”

- “Peace of Mind Emergency Fund”

This isn’t just a cute trick; it’s powerful psychology. As this comprehensive guide from Forbes explains, setting specific financial goals transforms saving from a chore into a motivating journey.

When you’re tempted to make an impulse purchase, you’re not taking money from a vague “savings” account. You’re taking it directly from “Hawaii.” Suddenly, the choice becomes much clearer.

One of the first buckets you should create is for your emergency fund. Having this safety net is a core part of any solid plan, especially when you’re thinking about bigger goals like building a college savings strategy for your kids.

Tip #3: Track Your Wins, Not Your Spending (The Psychology Trick)

Traditional budgeting often fails because it focuses on what you can’t do. It’s full of restriction and can make you feel guilty about every dollar you spend.

My third and final tip flips this around.

Forget tracking every single coffee. Instead, track your progress.

Once a week, or once a month, take just five minutes to look at your savings buckets. See how much they’ve grown. Celebrate that progress!

This creates a positive feedback loop. You start to enjoy the feeling of seeing those numbers go up. It becomes a game you want to win, rather than a chore you have to endure.

This is one of the most effective and easy saving tips because it works with your brain’s reward system, not against it.

Your Journey From Saver to Investor

Mastering these three easy saving tips is the first, most crucial step in taking control of your financial life.

You build the habit, you create a safety net, and you gain confidence.

Once you’ve built that small cushion and feel the momentum, you might be ready for the next exciting step: making your money start working for you.

My guide on how to start investing with just $100 is the perfect place to begin that next chapter. It follows the same simple, step-by-step philosophy.

But for today, just focus on these three simple steps. They are the bedrock of a secure financial future.

If you want a simple map that puts these principles and more into one place, I’ve got you covered.

Grab my free [7-Minute Retirement Quickstart PDF]. It’s the simple map you need to start building a future that’s secure, one easy step at a time.