Hey, friends. Alex here.

When people ask me for a list of the best books on investing for beginners, they usually expect a list of thick, intimidating textbooks full of charts and formulas.

My answer often surprises them. I tell them to forget the textbooks, at least for now.

Because I believe the single best book you can read to become a successful investor has almost nothing to do with stock market tactics, and everything to do with understanding yourself.

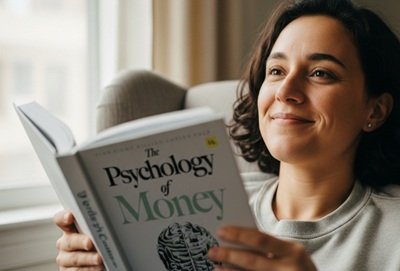

That book is The Psychology of Money by Morgan Housel. And today, I want to tell you why I wish I had read it in my 20s.

Why This Book is Different

I’ve read a lot of investing books. Most of them are dry and complicated. They make you feel like you need a Ph.D. to succeed.

The Psychology of Money is the exact opposite. It’s a collection of 19 short, powerful stories that reveal the hidden psychological forces driving our financial decisions.

The author, Morgan Housel, is not your typical finance guru. As you can see on his website, his background is in writing about how people think and behave. He’s a partner at The Collaborative Fund and a former columnist for The Motley Fool and The Wall Street Journal. This is why his approach to money is so unique and powerful.

This book won’t give you hot stock tips. Instead, it will give you something far more valuable: wisdom.

Lesson #1: “Pretty Good” Over the Long Haul Beats “Perfect” in the Short Term

This was a lightbulb moment for me. The book shows that most legendary investors weren’t successful because they were the smartest people in the room every single year.

They were successful because they were consistently “pretty good” for a very, very long time, and they avoided catastrophic mistakes.

The goal isn’t to be a genius; it’s to have a system that’s hard to mess up. That’s the entire philosophy behind our guide to common sense investing.

This insight is incredibly liberating. It gives you permission to not know everything. You just need a simple, sensible plan, and the discipline to stick with it.

Lesson #2: Compounding is About Endurance, Not Just Math

We all know about compound interest. But Housel brilliantly explains that the real magic of compounding isn’t just about math; it’s about endurance.

It’s about having the patience and resilience to stay invested long enough for the magic to happen.

This is the same powerful idea we explored when we looked at how a simple board game can teach us about finance. It’s not the one-off brilliant move that builds wealth; it’s the slow, steady, almost boring consistency.

Understanding this changes how you view market downturns. They are no longer terrifying events; they are simply part of the long journey.

Lesson #3: True Wealth is Controlling Your Time

This might be the most profound lesson in the entire book.

Housel argues that the highest form of wealth isn’t a fancy car or a big house. It’s the ability to wake up every morning and say, “I can do whatever I want today.”

It’s about having the freedom and the options to live life on your own terms.

This insight redefines the goal of investing. It’s not just about accumulating more money. It’s about using money as a tool to buy back your time and create a life you love. This makes the entire journey more meaningful.

Why It’s One of the Best Books on Investing for Beginners

I’m not the only one who thinks this book is a masterpiece. It has become a global phenomenon, with hundreds of thousands of glowing reviews on platforms like Goodreads from regular readers who, like us, found its wisdom to be life-changing.

It’s a book you can read in a weekend but will think about for a lifetime. It’s written in short, easy-to-digest chapters, perfect for busy people.

Reading The Psychology of Money will give you the ‘why.’ It builds the unshakeable mental foundation you need to succeed.

When you’re ready for the ‘how,’ my guide on how to start investing with just $100 will be waiting for you.

If you feel that this is the book you need to build your foundation, you can learn more about The Psychology of Money directly from its publisher, Harriman House.

Link to The Psychology of Money at Harriman House

To be crystal clear, this is not an affiliate link and we have no financial relationship with the publisher or the author. Our only goal is to share a resource that we genuinely believe will change your relationship with money for the better. We just think it’s that important.

And when you’re ready for a simple map that puts these principles into action, I’ve got you covered.

Grab my free [7-Minute Retirement Quickstart PDF]. It’s the simple map you need to start building a future that’s secure.