Hey, friends. Alex here.

So, you’ve made a huge decision. You’re ready to start investing for your retirement. You’ve heard great things about Fidelity, but now you’re facing that final hurdle: the setup process. If you’re wondering exactly how to open a Fidelity IRA without getting lost or overwhelmed, this guide is for you.

I remember that feeling. The idea of filling out financial forms can feel more intimidating than the investing itself.

But here’s the truth: it’s simpler than you think.

Today, we’re not just going to click buttons. We’re going to walk through a simple, 5-step strategic plan that will leave you feeling confident and in control.

Step 1: Your “Why” – The Goal That Keeps You Going

Before you even go to Fidelity’s website, take a moment. Why are you doing this?

Is it to enjoy a peaceful retirement on a sunny beach? Is it to ensure you have the freedom to travel and spend time with your grandkids?

Picture that future. That is your “why.” It’s the most powerful motivation you have, and it will keep you on track for years to come. This is the first, most important step in learning how to open a Fidelity IRA.

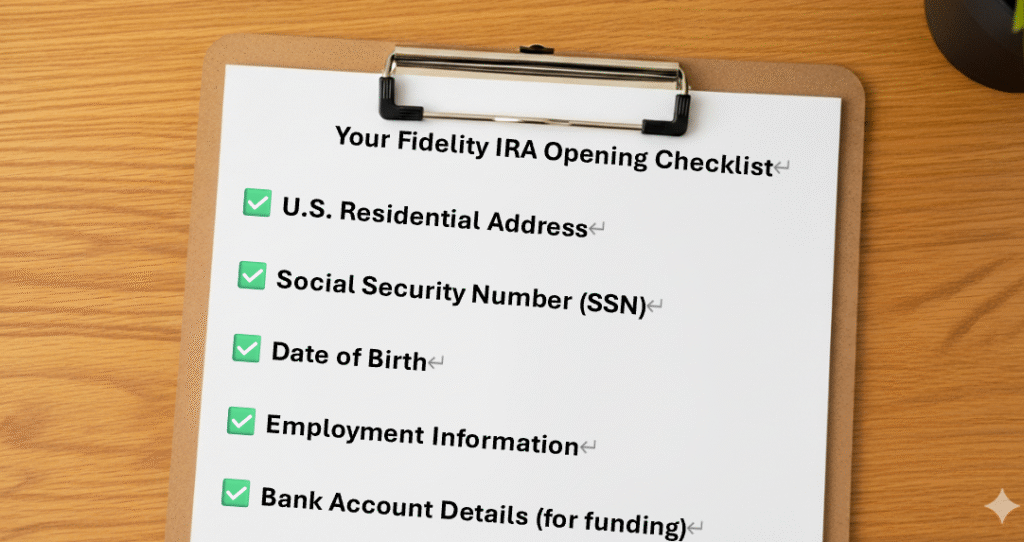

(H2) Step 2: Your Prep – The “No-Stress” Checklist

The biggest cause of frustration when opening an account is not having the right information ready. Let’s eliminate that stress right now.

Here is a simple checklist of everything you’ll need. Gather these items, and the rest of the process will be a breeze.

Having these ready isn’t just a practical step; it’s a mental one. It puts you in the driver’s seat.

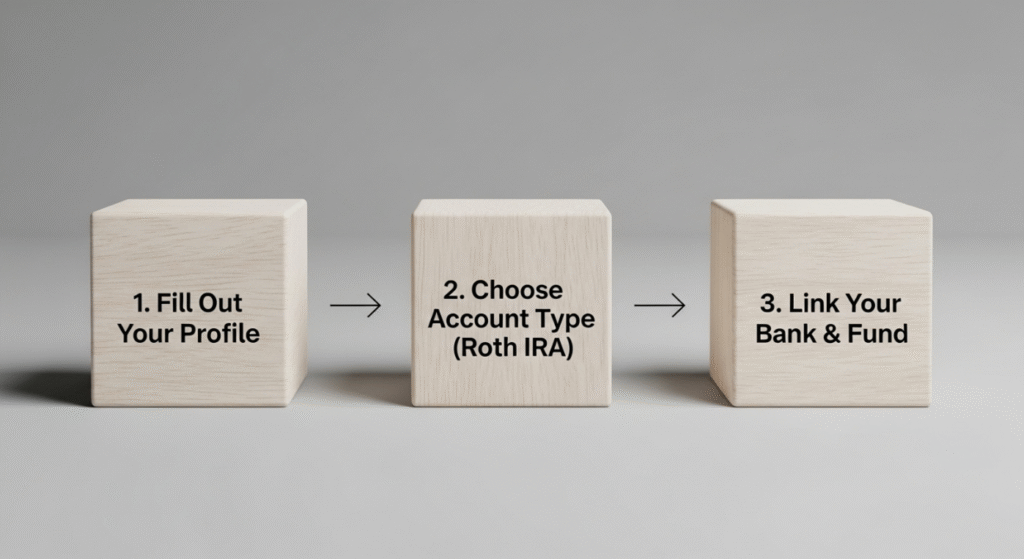

(H2) Step 3: The Big Picture – A Simple 3-Stage Path

The actual online process can be broken down into three simple stages. Don’t worry about the specific screens just yet. Just understand the path.

That’s it. You’re telling them who you are, what kind of account you want, and how you’ll fund it. By seeing the whole map upfront, the journey becomes much less intimidating.

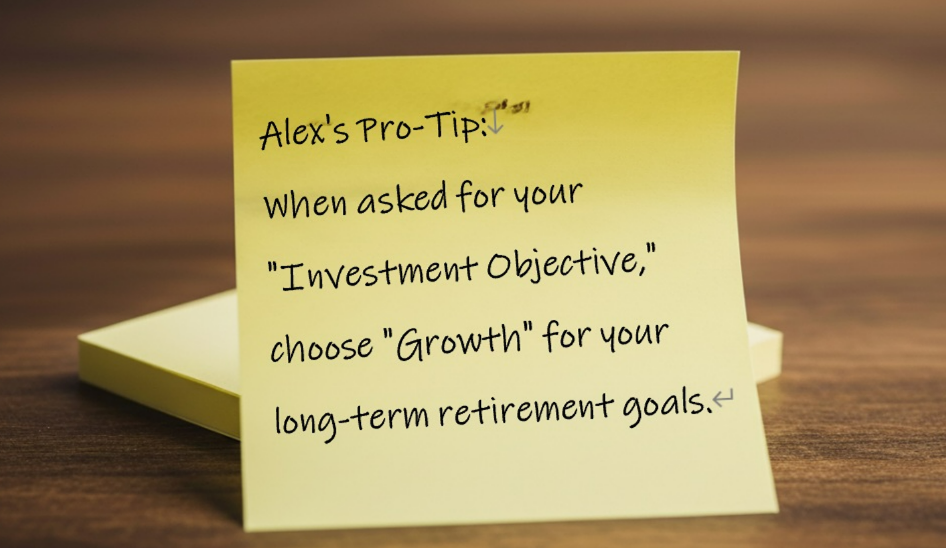

(H2) Step 4: The “Insider” Tip – What to Watch Out For

This is the part that official guides won’t tell you, but as a friend who has been there, I want you to know.

During the setup, Fidelity will ask for your “Investment Objective.” This can be a confusing question.

- Alt Text: An infographic tip card from Alex Bennett about choosing “Growth” as the investment objective when opening a Fidelity IRA.

Choosing “Growth” signals that you are investing for the long term, which is exactly what a retirement account is for. It’s a small choice that makes a big difference. This little piece of wisdom is key to understanding how to open a Fidelity IRA the right way.

(H2) Step 5: Your First Action – From Plan to Reality

Now that you have your “why,” your checklist, and your insider tip, you are more prepared than 99% of people.

You are ready to take action.

The final step is to go to the starting line. You can begin your journey directly on Fidelity’s official account opening page. This is where your plan becomes reality.

Once your account is open and funded, the next big question is: what should you actually buy? For most beginners, the answer is simpler than you think. Our guide on how ETFs work for beginners explains why a single S&P 500 ETF is the perfect place to start.

(H2) Conclusion: You Are Ready

See? Figuring out how to open a Fidelity IRA is less about technical clicks and more about confident preparation.

You now have a strategic plan. You know what you need, you know the path, and you know the key decisions to make.

While this guide focuses on Fidelity, remember that the principles of preparing and planning are universal. If you’re still weighing your options, our Vanguard vs. Fidelity comparison can help you understand which platform feels right for you.

You are no longer a passive observer. You are an empowered planner, ready to take control of your financial future.

If you want a simple map that puts these core principles into one place, I’ve created a resource just for you.

Grab my free [7-Minute Retirement Quickstart PDF]. It’s the simple map you need to start building a future that’s secure.