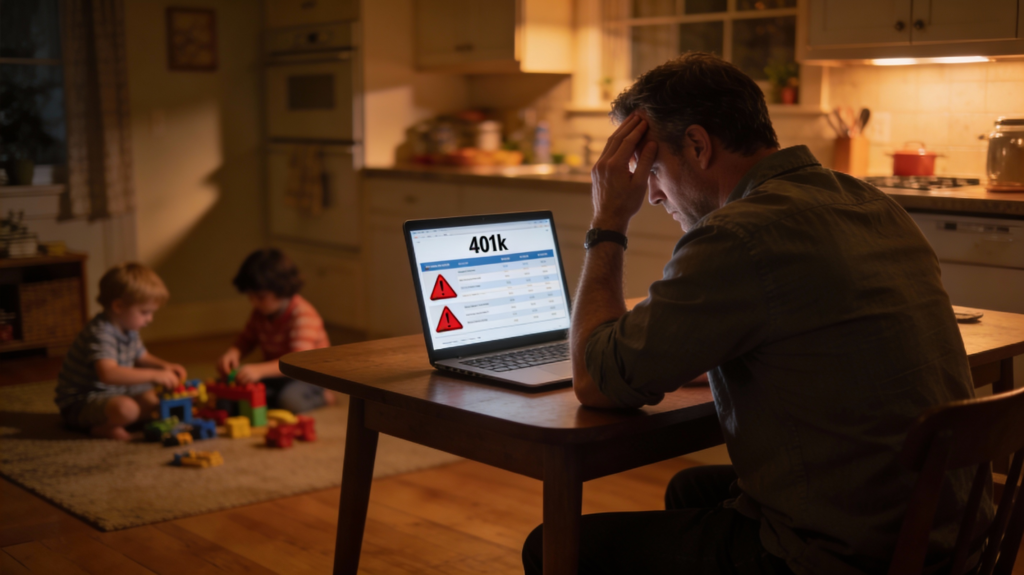

Hey, if you’re in your 40s juggling work, kids, and that mortgage, that 401(k) you set up years ago is probably just sitting there—quietly losing you over $100,000 to high fees and crappy default funds.

You think it’s “fine,” but it’s not. Most parents like us don’t even know it’s happening. In this guide, I’ll walk you through my 1-hour fix: spot the problem, make one smart switch, and automate it so you reclaim family time without the guilt.

The Silent $100K Killer in Your 401(k)

Picture this: A dad like Mark—42, two kids, $120K salary. His 401(k) shows $60K. Solid, right? Wrong. We logged in, and it was parked in a “Target Date 2050 Fund” with a 0.9% expense ratio.

That “tiny” fee? Over 25 years, it eats $100K+ of your growth. Target date funds sound safe, but they charge 20x more than index funds and stuff in bonds you don’t need yet.

Fees + over-diversification = slow leak. Your money works for Wall Street, not your family.

Try this 401(k) Fee Calculator to see your leak

The 1-Hour Fix: 3 Simple Steps

No spreadsheets, no stock picking. Just log in, check, switch. Done.

Step 1: Look – Know What’s Eating Your Money (10 mins)

Log into your 401(k) portal (check payroll or HR email). Find the “Funds” section.

Red flags:

- “Target 2050” or “Balanced Fund”

- Expense ratio > 0.3%

Jot it down. Don’t panic—this is just intel.

Step 2: Compare – Target Date vs True Index Funds (20 mins)

Google your fund vs an S&P 500 or Total Market index fund from Fidelity, Vanguard, or Schwab.

| Fund Type | Expense Ratio | 25-Year Cost on $100K Investment |

|---|---|---|

| Target Date 2050 | 0.9% | $100K+ lost |

| S&P 500 Index | 0.03% | Near $0 |

Target Date vs Index Funds Breakdown

One switch = $80K–$120K back in your pocket. Vanguard vs Fidelity Comparison

Calculate your expense ratio impact

Step 3: Automate – Set It & Forget It (30 mins)

- Direct new contributions to the low-cost index fund.

- Choose Roth 401(k) if available (tax-free growth shines at ~$120K income).

- Enable auto-reinvest dividends.

Log out. Your money now compounds quietly while you coach soccer or date night.

Why This Changes Everything for Busy Parents

This isn’t chasing hot stocks—it’s removing dashboard dread. That extra $100K? College funds, family trips, or just breathing room.

Download Free 1-Hour 401(k) Checklist – Plug in your numbers, get your plan.

Next Steps on Your Wealth Map

- Start Here Playlist – Roth vs Traditional next.

- 3-ETF Lazy Portfolio – Beyond 401(k).

Not financial advice—confirm with your plan rules and a pro.

You’ve wasted enough time. Grab your $100K back today.