Hey, friends. Alex here.

Did you see the news this week? With so many confusing signals, it’s easy to wonder how to invest during a recession—or if one is even coming. On one hand, headlines celebrated that inflation is cooling. On the other, reports show more people are struggling with their credit card bills.

It feels a bit like driving with one foot on the gas and one foot on the brake, doesn’t it?

If that thought has crossed your mind, you’re not alone. Let’s talk about it calmly and create a simple, practical plan.

First, Let’s Understand the Real Warning Signs

It’s easy to get swept up in the daily market noise. But the real story often lies in the details.

This week, while the inflation report was a relief, there were other, quieter signals we need to pay attention to. According to a recent report from the Federal Reserve Bank of New York, credit card and auto loan delinquencies have been rising, especially among younger households.

In simple terms, this shows that American families are feeling the financial pressure. This is exactly why learning how to invest during a recession (or the fear of one) is less about chasing high returns and more about building a financial fortress for your family.

My 3-Pillar Strategy for Investing in Uncertain Times

When things feel uncertain, many people ask me for my core strategy on how to invest during a recession. The worst thing you can do is panic. The best thing you can do is prepare. Here are the three pillars I use to keep my own family’s finances steady, no matter what the economy is doing.

Pillar 1: Fortify Your Defenses (Your Emergency Fund is King)

Before you even think about investing, you need a solid foundation. In times like these, your emergency fund is the most important asset you have. It’s the buffer that keeps you from having to sell your investments at the worst possible time.

Aim for 3-6 months of essential living expenses in a high-yield savings account. It won’t make you rich, but it will let you sleep at night. That peace of mind is priceless.

If you’re wondering how to get started, I have an article on how to build your financial foundation with just $100, which also covers the importance of saving.

Pillar 2: Play the Long Game with Consistency

Here’s a secret that’s central to learning how to invest during a recession: these downturns can actually be a huge opportunity for long-term investors. When the market is down, every dollar you invest buys you more shares of great companies. It’s like your favorite store having a sale.

The smartest and simplest way to execute this is through “dollar-cost averaging”—a fancy term for investing the same amount of money on a regular schedule. As financial leader Fidelity explains in their guide, this disciplined approach can help lower your average cost per share over time.

For most of us, this means setting up an automatic investment into a low-cost S&P 500 ETF and letting it run.

If the term ‘ETF’ is new to you, please don’t worry. It sounds more complicated than it is. I wrote a simple guide that breaks it all down right here: [What’s an ETF? Investing Basics Explained].。

Pillar 3: Understand What a Recession Actually Is (and Isn’t)

A big part of knowing how to invest during a recession is simply understanding what a recession actually is (and isn’t). The word sounds terrifying, but let’s demystify it. According to the National Bureau of Economic Research (NBER), it’s simply a significant decline in economic activity that lasts for more than a few months.

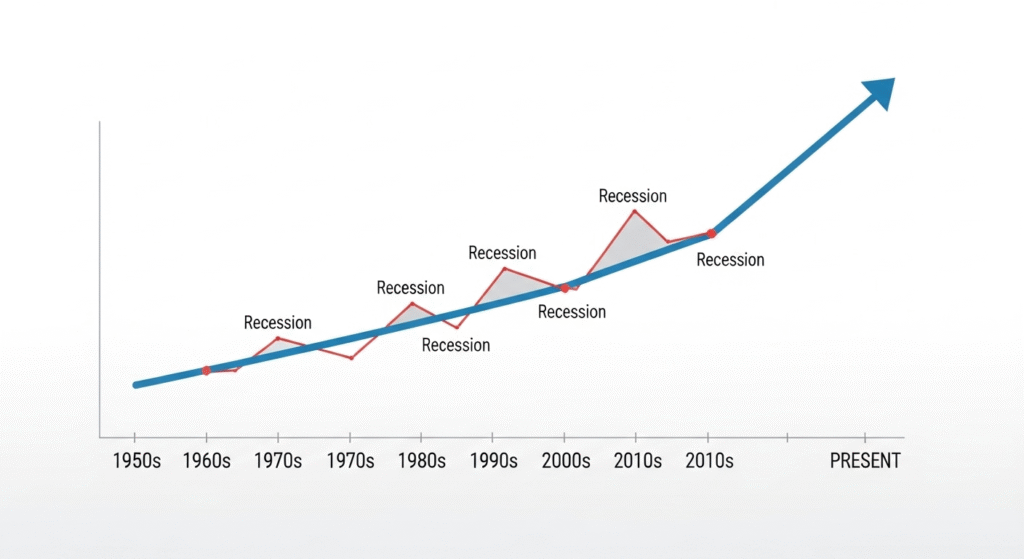

The key word is “decline,” not “end.” It’s a phase, not a permanent state. History has shown us that the economy, and the stock market, have always recovered and gone on to reach new highs.

Knowing this helps us shift our mindset from fear to focus. Our job isn’t to predict when a recession will start or end. Our job is to have a plan that works right through it.

Your Simple, Actionable Plan

So, when you see those mixed headlines, take a deep breath. You don’t need to panic, because you now have a clear framework for how to invest during a recession.

Your plan is simple:

- Check Your Foundation: Is your emergency fund solid? If not, make that your #1 priority.

- Automate Your Investing: Stick to your regular, automated investments in low-cost ETFs. Don’t try to time the market.

- Tune Out the Noise: Focus on your long-term goals, not the daily panic or hype from financial news. We actually talked about this recently when we covered Invest with Confidence in 2025: My 3-Step Beginner’s Guide. The core principle is exactly the same. *

Having a clear, simple strategy is the ultimate antidote to financial anxiety. It’s how I learned to navigate these waters for my family, and I know it can work for you too.

If you’re ready to build that foundation, I’ve put all my core principles into one place. Grab my free [7-Minute Retirement Quickstart PDF]. It’s the simple map you need to start building a future that’s secure, no matter what the headlines say.