Hey, friends! Alex here.

Let me tell you the biggest lie the financial news sells you every single day: You need to pick the next winning stock.

I bought into that lie for years. I was spending my evenings gambling with my family’s money, trying to be a Wall Street genius from my kitchen table. I was exhausted, anxious, and losing money.

What if I told you that entire game—the one that leaves you feeling like you’re always one step behind—is a trap?

You don’t have to play it at all.

You don’t need a superstar’s talent to build wealth. You just need a system. A simple, powerful system designed for the rest of us.

Today, I’m giving you the exact blueprint: my 3-ETF Portfolio. It’s the smart, simple way to own the entire market.

1. The Trap of the Pro Game (Why You Must Stop Picking Stocks)

Imagine two games of basketball.

The first game—the Pro Game—is where you try to pick the next Steph Curry. They have inside data, speed, and teams of analysts. It’s a game of prediction.

Every time you try to time the market or jump on a hot stock tip, you’re stepping onto their court. And you will get crushed. This is a battle you are designed to lose.

The Real Lesson

My own embarrassing failure (the $50 mistake) taught me this: successful investing isn’t about finding the next rocket ship. It’s about building a system that protects you from your own emotional weakness.

If you want to read my story about how I finally beat the anxiety that kept me paralyzed, check out my $50 mistake story here.

2. Pillar One: The Blueprint (Three Engines for Your Wealth Machine)

Instead of betting on which single stock will score next, the goal of our game is simple: Own the entire court.

When any point is scored, by any company, in any market around the world, you win. This philosophy is the foundation of the 3-ETF Portfolio.

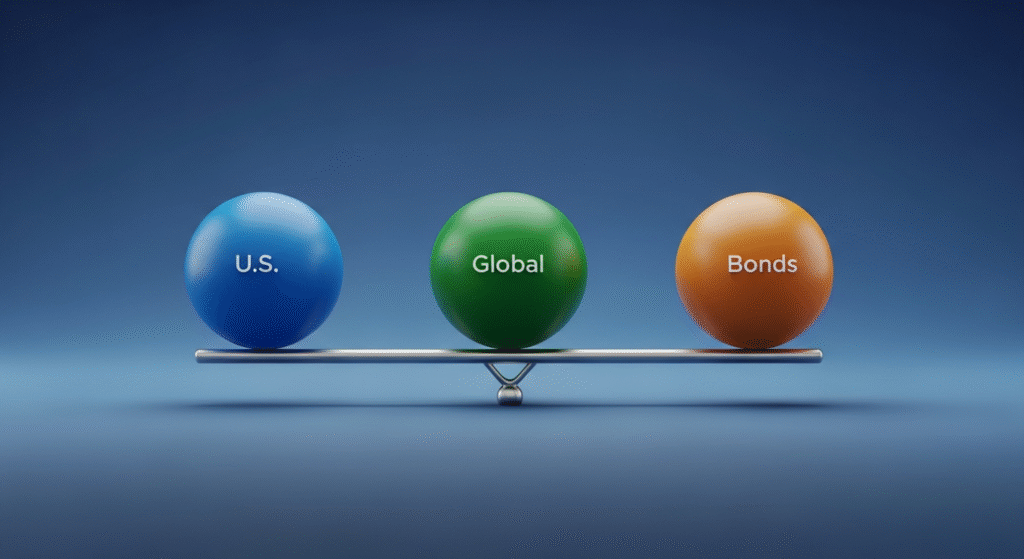

So, how do we build this machine? We build it with just three core components. Think of them as the three engines of your financial vehicle.

Engine 1: The U.S. Powerhouse (The Growth)

This is the main engine of your portfolio. This single ETF lets you own a tiny piece of thousands of large and small, innovative American companies. You are betting on the entire American economy.

- Goal: Long-term, powerful growth.

- Typical Allocation: 50% to 60% of your total investment.

Engine 2: The Global Navigator (The Balance)

A car with only one engine is not resilient. The world is a big place. This second ETF lets you own thousands of successful businesses outside the U.S. This is your built-in diversification and global safety net.

- Goal: Global balance and resilience.

- Typical Allocation: 20% to 30%.

Engine 3: The Shock Absorber (The Stability)

Every powerful vehicle needs a world-class braking system. This third component is a collection of high-quality bonds. When the stock market gets chaotic, the bonds are the anchor that keeps your ship steady. They protect you from panic-selling.

- Goal: Reduce volatility and provide stability.

- Typical Allocation: 10% to 20% (Adjusted by age).

That’s the entire blueprint. A U.S. engine, a Global engine, and a Shock Absorber. This is the essence of the 3-ETF Portfolio.

The real beauty is that this simple three-fund approach is so powerful that it has been widely endorsed by investment legends. If you want to dive into the specifics of how this works and why it’s so stable, you can read more about the long-term advantages of the three-fund portfolio on Bogleheads Wiki.

Beyond the math, the reason this plan works is its simplicity—it removes the pressure to pick stocks. If you want a quick breakdown of the practical steps and the mental benefits of using this method, this guide highlights how the three-fund portfolio simplifies investing and improves your peace of mind.

3. Pillar Two: Proving Simplicity Works

If you doubt that three funds can beat complex strategies, you aren’t alone. I was skeptical too. But the math doesn’t lie.

Studies consistently show that this straightforward approach has delivered excellent risk-adjusted returns, even when facing major downturns.

If you want proof, check out this review that breaks down the performance and risk protection of the 3-ETF Portfolio. It’s fascinating how simplicity actually is the ultimate sophistication in investing.

4. Pillar Three: Making the System Work For You

This 3-ETF Portfolio is inherently passive. It’s designed to be built once and checked occasionally.

The key to its success isn’t the funds themselves, but the system around them.

The system is simple: build the machine, then let the machine build your wealth for you.

If you want the full guide on how to automate this entire portfolio—including the one-hour-a-year checkup—I covered that in my core system guide: My 1-Hour Rule: Set It and Forget It Investing in 3 Steps.

This simple 3-ETF Portfolio approach is highly effective. In fact, if you feel behind, this strategy is perfect for you. My other guide shows exactly how this blueprint can help you Catch Up on Retirement.

5. Your Next Big Decision: Where to Buy?

So now you have the blueprint—the 3-ETF Portfolio. You know what to buy.

But the next big question is… where to buy it? Choosing the right platform—the right brokerage—is a huge decision, and you want a partner you can trust for the long term.

That’s why my next step is to break down the specific brokers I trust for implementing this strategy. When looking for a brokerage to implement your 3-ETF Portfolio, make sure they offer low-cost or commission-free access to VTI, VXUS, and BND (or similar funds).

We’ll be comparing two of the most trusted and respected platforms in the industry to see which one is the better fit for your family.

Conclusion: Own the Market, Reclaim Your Life

You don’t need to be a stock-picking prodigy. You just need the wisdom to own the market.

This 3-ETF Portfolio gives you the calm, mental space, and freedom you deserve.

Your Action Plan Awaits: Ready to calculate your exact percentages and take the first step? I’ve distilled my entire blueprint and simple tools into a free PDF guide.

👉 Click Here to Grab My FREE “7-Minute Retirement Quickstart” Guide!

Now go, and build your machine.